Introduction

The 1980s were a time of significant change in the UK. Cultural revolutions, and a growing entrepreneurial spirit. For many, the transition from SC60 employment to self-employment was both daunting and exhilarating. This article delves into the experiences of those who made the leap, exploring the nuances and dynamics of being self-employed in the sc60 vs self employed uk 80’s.

What is sc60 vs self employed uk 80’s?

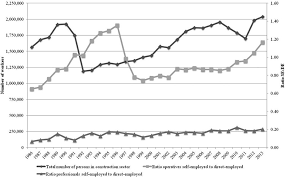

Before we dive into the nitty-gritty of self-employment in the 80s, let’s first understand what SC60 was. SC60 was a tax certificate issued by the Inland Revenue. (Now HM Revenue & Customs) to subcontractors in the construction industry. It allowed them to receive payments without tax deductions at the source, provided they were up-to-date with their tax affairs. This system was a stepping stone for many who later transitioned into full-fledged self-employment.

The Mechanics of sc60 vs self employed uk 80’s

- Eligibility: Subcontractors had to prove that they were compliant with tax regulations.

- Benefits: Allowed for better cash flow management as tax was not deducted at source.

- Limitations: Primarily for the construction industry, making it specific to that sector.

The Self-Employed Boom

The Economic Landscape of the 80s

The 1980s saw significant economic reforms under Prime Minister Margaret Thatcher. Policies aimed at deregulation, privatization, and reducing the power of trade unions created a fertile ground for entrepreneurship. For many, this was the perfect opportunity to break free from traditional employment structures and take control of their financial destinies.

Why the Shift from SC60?

- Flexibility: The desire for greater control over work schedules and project choices.

- Financial Incentives: The potential for higher earnings and tax benefits.

- Innovation: The ability to capitalize on new market opportunities and technological advancements.

Challenges of Being Self-Employed in the 80s

Navigating the Tax System

One of the biggest hurdles was understanding and managing taxes. Unlike the structured SC60 system, self-employment required meticulous record-keeping and an in-depth understanding of tax obligations.

- Self-Assessment: Introduced in the late 80s, self-assessment required individuals to declare their income and calculate their tax liabilities.

- National Insurance Contributions: Self-employed individuals had to manage their Class 2 and Class 4 National Insurance Contributions.

Financial Instability

The transition from SC60 to self-employment often brought about financial instability. Without a guaranteed income, many faced periods of feast and famine.

- Irregular Income: Earnings fluctuated based on projects and market conditions.

- Savings and Investments: The need to build a financial cushion for lean periods.

Limited Support Systems

In the 80s, there were limited resources and support systems for self-employed individuals. Unlike today, where entrepreneurs have access to a plethora of online resources, networking groups, and financial advisors, the 80s were a time of self-reliance.

- Isolation: Working independently often led to feelings of isolation and lack of community support.

- Resource Scarcity: Limited access to business advice, mentorship, and financial services tailored for small businesses.

Success Stories

Despite the challenges, many thrived and became successful entrepreneurs. Here are a few inspiring stories:

Jane’s Journey: From Subcontractor to Boutique Owner

Jane was a subcontractor under the SC60 scheme, working in the construction industry. Tired of the physical demands and seeking a creative outlet, she opened a boutique in London. Her attention to detail and unique fashion sense quickly garnered a sc60 vs self employed uk 80’s, her boutique was a staple in the local fashion scene.

Mike’s Tech Revolution

Mike, a former SC60 subcontractor, had a knack for electronics. Spotting the burgeoning tech wave, he started a small business selling computer components. As the personal computer revolution took off, Mike’s business grew exponentially, making him a pioneer in the tech retail industry.

Tips for Aspiring Entrepreneurs

Embrace Continuous Learning

The 80s taught us the importance of staying updated with industry trends and continuously learning new skills. Whether it’s mastering new technologies or understanding market dynamics, continuous learning is crucial.

Build a Network

While the 80s lacked robust support systems, today’s entrepreneurs have the advantage of networking. Join local business groups, attend industry conferences, and engage with online communities.

Financial Planning

Proper financial planning can mitigate the risks of irregular income. Create a budget, build an emergency fund, and consider working with a financial advisor.

FAQs

Q: What was the main advantage of SC60?

A: The primary benefit of SC60 was better cash flow management, as it allowed subcontractors to receive payments without tax deductions at source, provided they were compliant with tax regulations.

Q: Why did many choose to become self-employed in the 80s?

A: The economic policies of the 80s, combined with a desire for greater flexibility, financial incentives, and the opportunity to innovate, motivated many to pursue self-employment.

Q: What were the biggest challenges for self-employed individuals in the 80s?

A: Navigating the tax system, financial instability, and limited support systems were some of the major challenges faced by self-employed individuals during that time.

Q: How did successful entrepreneurs in the 80s overcome these challenges?

A: Many relied on continuous learning, building strong networks, and prudent financial planning to overcome the hurdles of self-employment.

Conclusion

The transition from sc60 vs self employed uk 80’s a significant leap of faith for many. It was a time of exploration, innovation, and resilience. While the journey was fraught with challenges, it also opened doors to immense opportunities and success. By understanding the historical context and learning from the experiences of those who navigated this path, today’s entrepreneurs can draw valuable lessons and inspiration. Whether you’re considering self-employment or already on that journey, remember that every challenge is an opportunity in disguise. Embrace it with an open mind and a determined spirit.