Creating a financial plan that grows with you is essential to ensure your financial well-being throughout your life. Life circumstances evolve, from starting a career to building a family, and eventually entering retirement. A well-structured financial plan should be flexible enough to accommodate these changes, particularly in places like Florida, where a large number of retirees reside. If you live in Ponte Vedra Beach or anywhere in Florida, having a plan that adjusts over time, especially for retirement planning Florida, is crucial. This guide will walk you through the key elements and strategies needed to create a financial plan that adapts as you grow.

1. Establishing Your Financial Goals

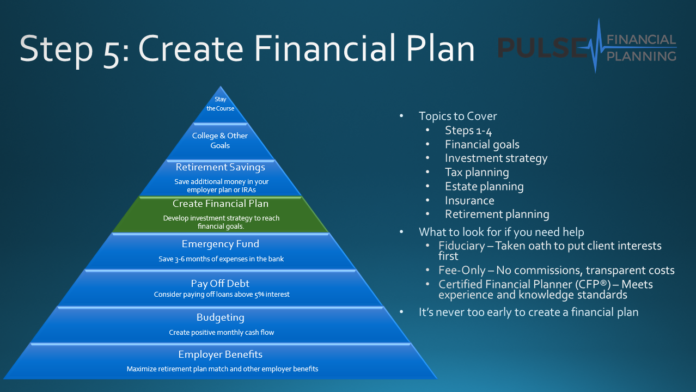

The first step in creating a long-term financial plan is setting clear, achievable goals. Your goals will serve as the foundation of your financial strategy and will likely evolve over time. Initially, these might include short-term goals like saving for a house, vacation, or wedding. Over time, long-term goals, such as building retirement savings, providing for your children’s education, and creating an emergency fund, become more important.

When establishing these goals, it is vital to account for their timelines and financial impact. You may need to prioritize certain objectives over others, which is where seeking advice from a financial advisor Ponte Vedra Beach FL can help. Professional advice ensures that your financial goals are realistic and aligned with your lifestyle.

2. Budgeting and Saving: The Foundation of Your Financial Plan

Once you have set your financial goals, the next step is creating a budget that enables you to save for them. A budget is the foundation of any financial plan because it provides a roadmap for your income and expenditures. Track your spending and compare it to your income to ensure you can allocate savings for each of your goals.

A good rule of thumb is to follow the 50/30/20 rule, which breaks down your budget into three categories:

- 50% for needs (housing, utilities, groceries),

- 30% for wants (entertainment, dining out),

- 20% for savings and debt repayment.

This method allows for flexibility as your income and responsibilities change. The savings portion should also include contributions to your retirement accounts, especially if your goal is retirement planning Florida. By sticking to a budget and focusing on savings, you can lay a strong foundation for long-term financial health.

3. Planning for Retirement Early On

One of the most important aspects of a growing financial plan is early and consistent retirement planning Florida. Many people underestimate how much they will need to retire comfortably, especially in states like Florida, which is known for its retirement communities and cost of living considerations.

To ensure your retirement plan grows with you, consider the following steps:

- Start contributing to retirement accounts early: Whether it’s a 401(k), IRA, or other tax-advantaged retirement account, contribute regularly. Max out contributions if possible, especially if your employer offers a matching contribution.

- Increase contributions as your income rises: As you earn more throughout your career, it’s crucial to boost your retirement contributions. This will help your retirement savings grow and keep up with inflation.

- Diversify your investments: To protect your retirement savings, diversify your portfolio with a mix of stocks, bonds, real estate, and other assets. A diversified portfolio will help cushion market fluctuations over time.

- Seek professional guidance: A financial advisor Ponte Vedra Beach FL can provide valuable insight and recommend strategies tailored to your retirement goals. Professional financial planning ensures you’re on track to meet your retirement needs.

4. Adapting to Major Life Events

Life events such as getting married, having children, purchasing a home, and advancing in your career are milestones that will impact your financial plan. As your circumstances change, your financial strategy should also adjust to reflect new priorities and responsibilities.

- Marriage and combining finances: If you get married, your financial plan must account for combining your income, expenses, and financial goals. You’ll need to align your retirement plans, debt repayment strategies, and savings goals.

- Having children: Parenthood introduces new financial responsibilities, from everyday expenses to long-term planning for education. Incorporate education savings plans such as a 529 plan, and ensure that your life insurance and estate planning are in order to protect your family.

- Purchasing a home: Buying a house is one of the most significant financial commitments you’ll make. It’s essential to adjust your budget and savings plan to accommodate mortgage payments, property taxes, insurance, and maintenance costs.

- Career advancement: As you progress in your career and your income increases, be sure to regularly update your financial plan. Allocate your raises or bonuses towards savings, investments, and debt reduction.

Regularly revisiting your financial goals and adjusting them as needed will ensure that your plan evolves with you and supports your changing lifestyle.

5. Building an Emergency Fund

An often-overlooked component of a financial plan is the emergency fund. Life is unpredictable, and having an emergency fund ensures you’re prepared for unexpected expenses such as medical bills, job loss, or major repairs.

Aim to save at least three to six months’ worth of living expenses in a high-yield savings account. If you face any sudden financial hurdles, an emergency fund can prevent you from dipping into your long-term savings or going into debt.

6. Managing Debt Wisely

Debt management is an integral part of any financial plan, especially when it comes to high-interest debt such as credit cards. Prioritize paying down high-interest debt first, and try to avoid accumulating unnecessary debt. Keeping your debt-to-income ratio low will free up more funds for savings and investments.

If you’re a small business owner, managing debt related to business growth and operations is just as important. A financial advisor Ponte Vedra Beach FL can help create strategies for managing both personal and business debt effectively.

7. Investing for the Future

Investments play a vital role in growing your wealth over time, but investing strategies should evolve as your financial situation changes. In your early career, you may have a higher risk tolerance and a longer time horizon, allowing you to invest more aggressively in stocks or growth assets. As you near retirement, shifting towards a more conservative portfolio with bonds and stable investments helps protect your savings from market volatility.

Consult with a financial advisor Ponte Vedra Beach FL to review your investment portfolio regularly and adjust it based on your current stage of life, risk tolerance, and financial goals.

8. Reviewing and Updating Your Financial Plan Regularly

Finally, the key to a financial plan that grows with you is regular reviews and adjustments. Life is dynamic, and so are financial markets and your personal circumstances. Set up an annual or biannual review with your financial advisor to ensure your plan remains relevant. By adjusting your plan based on current financial conditions, tax laws, and life events, you can maintain financial security and ensure that your long-term goals are on track.

Conclusion

Creating a financial plan that grows with you requires foresight, flexibility, and regular adjustments. From retirement planning Florida to managing debt and investing wisely, your financial plan should evolve alongside your life circumstances. Working with a trusted financial advisor Ponte Vedra Beach FL will help you stay on track and achieve your long-term financial goals. By following these best practices, you can ensure that your financial future remains secure and adaptable to whatever life throws your way.